Budgeting

Reasons to budget are as unique as people are. Maybe you want to learn more about how you spend, save for a large purchase, or are looking forward to retirement. Whether you’re starting to budget or trying to improve your budgeting skills, we have some tips and tricks that can help you achieve your financial goals.

Budgeting Basics

One of the first steps when building a budget is figuring out how you’re currently spending your money. You can start by making a list of your recurring expenses, like your housing payment or car insurance. Then look at your weekly or impulse purchases, like groceries or movie tickets. Once you know where you’re spending, you’ll have a better idea of how to budget and what changes you’d like to make. Check out this article from Federal Student Aid for more details.

All those little expenses add up! Did you know that if you set aside the $4 you would normally spend on coffee every day, you could save up to $1,000 a year? That little change can add up! Learn more ways to save on food and groceries from this AARP article. Click on the image below for the full-size infographic.

Looking for ways to save money? We have the list for you! AARP has 99 ways to save that cover many topics such as food, cars, home maintenance and more.

One helpful budgeting tool is the 50/30/20 Rule – spend no more than 50% of your income on living expenses (like housing, food and transportation) 30% on discretionary purchases (like gifts and entertainment), and 20% on financial goals (like retirement, schooling and an emergency fund). While everyone’s budget is different, 50/30/20 can be a good place to start. Click on the image below for the full-size infographic.

Budgeting During College

As you begin to think about college, look for scholarships to ease the strain on your budget. From the obvious to the obscure, the Department of Labor Scholarship Finder can help you, well, find scholarships (it’s right there in the name).

With these cool budgeting tools, you can budget from the comfort of your dorm room (or your couch, or anywhere, really). Some apps will do a lot of the work for you, giving you more time for homework (or binge watching that awesome new Netflix show).

Budgeting for Retirement

You may have thought of some of the obvious costs that come with retirement – housing, food, healthcare – but you might not have considered others, like spending on grandchildren and charitable donations. This U.S. News article lists some others you might need to take into consideration. Click the image below for the full-size infographic.

Expect the Unexpected

While no one wants an unexpected expense to pop up, being financially prepared can ease the stress when it does. Depending on who you ask, experts recommend having six months to one year’s worth of savings to cover unexpected expenses like car repairs, unemployment or medical bills. Get the details in this Consumer Financial Protection Bureau guide.

Budgeting for a Big Purchase

There are more costs associated with buying a home than just your down payment and monthly mortgage payment. When thinking about buying a home, you should also consider closing costs, taxes and fees, homeowner’s association dues and other costs as part of your budget. Check out this Consumer Financial Protection Bureau article for a list of potential expenses, including a description of each one. Click on the image below for the full-size infographic.

Want to fly to your vacation destination but afraid the cost of the flight will break your bank? Keep in mind when it’s best to look and book to get the best deals. Click the image below for the full infographic.

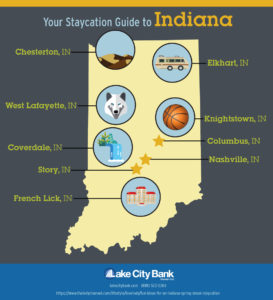

Don’t want to go too far for your vacation? If a staycation is more your speed, check out these budget-friendly options, all right here in Indiana! Click the image below for the full infographic.

So you know where and when you’re going for some rest and relaxation. How do you get there financially? First, you can estimate how much the trip will cost, then divide that cost by the number of months between now and your vacation. Put away a little each month to make your trip a reality.