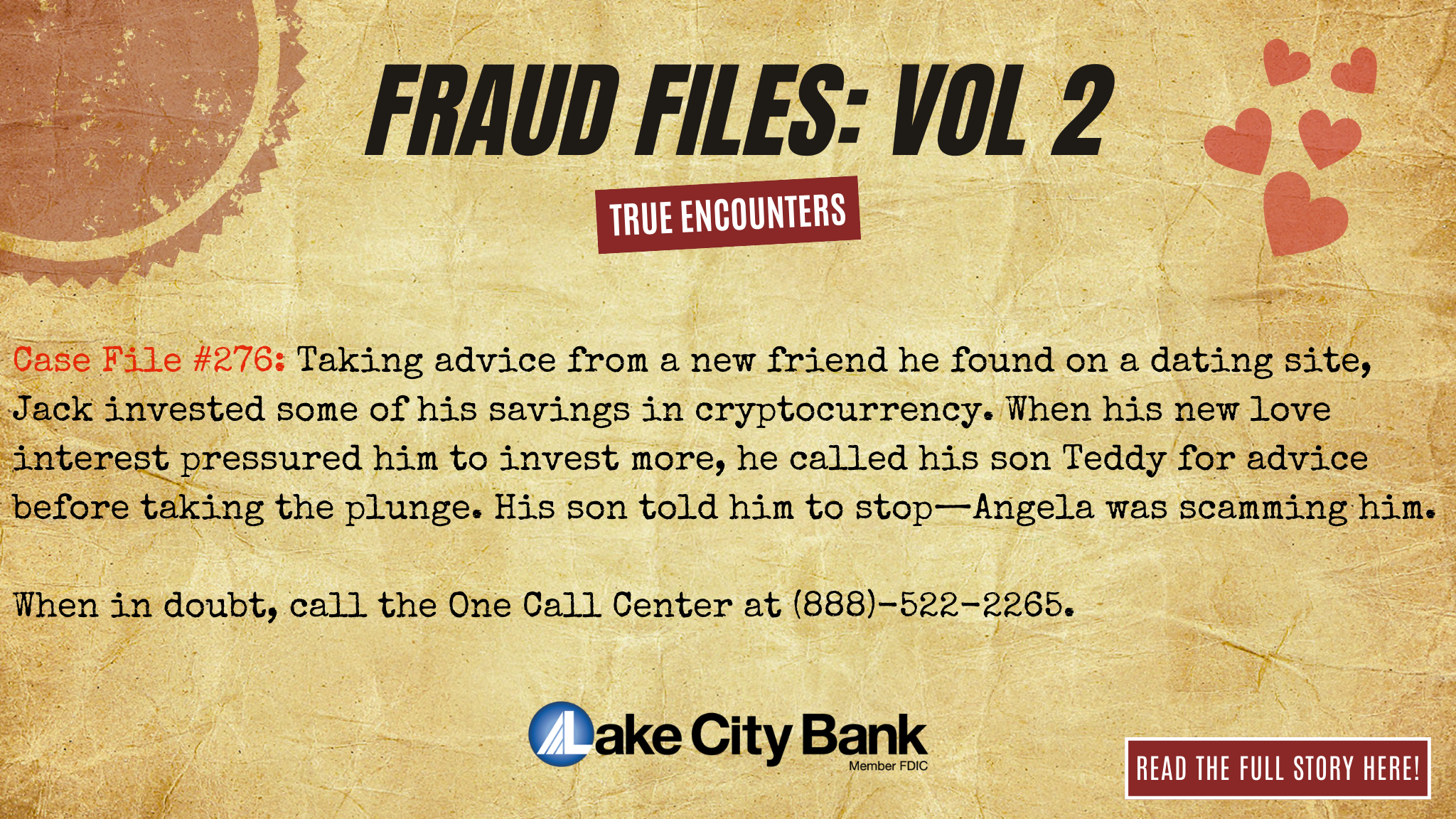

Cryptocurrency investment scam

Jack thought he had it made. Recently retired, he owned a small condo on the Florida Gulf Coast where he enjoyed walking his dog, golfing and fishing. The only thing missing was companionship. Jack explored a dating website for seniors where he met Angela, who seemed like a dream come true. Although she lived across the country, the two got to know one another first via email, and then over long phone conversations.

Angela seemed to know a lot about money and talked with Jack about getting more from his investments. She encouraged him to buy cryptocurrency. Jack was cautious—he enjoyed a nice lifestyle from the proceeds from selling his house up north, a small pension and his 401(k) account earnings. He didn’t want to rock the boat, but as he became closer to Angela, her stories of high and fast returns were tempting.

Jack gave in and invested a small amount of cryptocurrency. Soon, Angela began pressuring him to invest more. She said he should liquidate his 401(k) account and put the money in crypto. Jack felt uncomfortable moving his life savings to something he didn’t know much about, so he called his oldest son Teddy for advice. Teddy, who hadn’t heard about Angela until now, was worried about his father and suspected that Angela was a scam artist. He advised his father to leave his investments alone and break ties with Angela immediately. Jack resisted at first, but he took Teddy’s advice. With his son’s help, Jack also retrieved his original crypto investment.

Teddy explained to his father that scams like this were common, and many people had lost their life savings as a result. Jack was grateful that he stopped, but he was still lonely. He decided to hang out a bit more at the activity center in his condo complex where he met Elizabeth, a widow about his age. They’re taking ballroom dancing classes, walking their dogs together and enjoying one another’s company.

Jack’s story had a happy ending, but that’s not always the case. Scammers like Angela convince people to move their savings to crypto accounts, where they receive statements showing big earnings. Next, the scammers have their victims transfer their crypto accounts to a phony app. When the victim tries to retrieve their money from the app, it tells them that they must pay a big tax bill first. If they don’t pay the bill, the account is frozen, and the money is lost.

When in doubt, call the One Call Center at (888) 522-2265.

If you have any questions about cybersecurity, you can ask them using the form on our Contact Us webpage by visiting https://www.lakecitybank.com/contact-us/